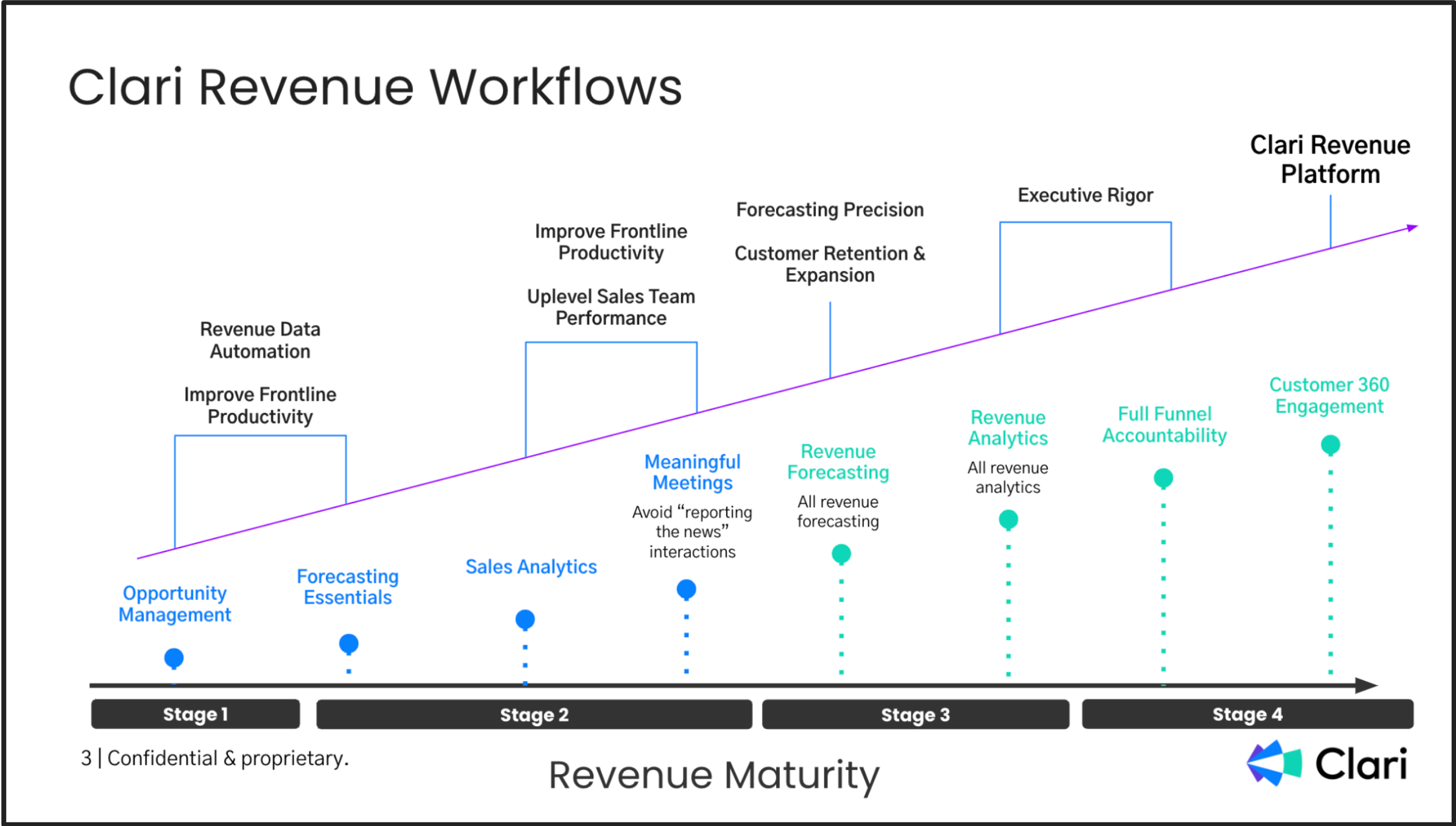

If we think about building an entire revenue journey, having a foundational strategy like MEDDPIC grounds the motions in the revenue process.

What is MEDDPICC?

- M: Agree upon Metrics and Mutual Business Objectives

- E: Identify an Economic Decision Maker in Team Roles

- D: Agree upon a Decision-Making Process and milestones

- D: Agree upon Decision Criteria in the MBO (Mutual Business Objectives) or POV (Proof of Value) milestone

- P: Manage Paper Process in a milestone

- I: Specify and Identified Pain in Mutual Business Objectives

- C: Identify a Champion in Team Roles

- C: Specify Competition in Clari

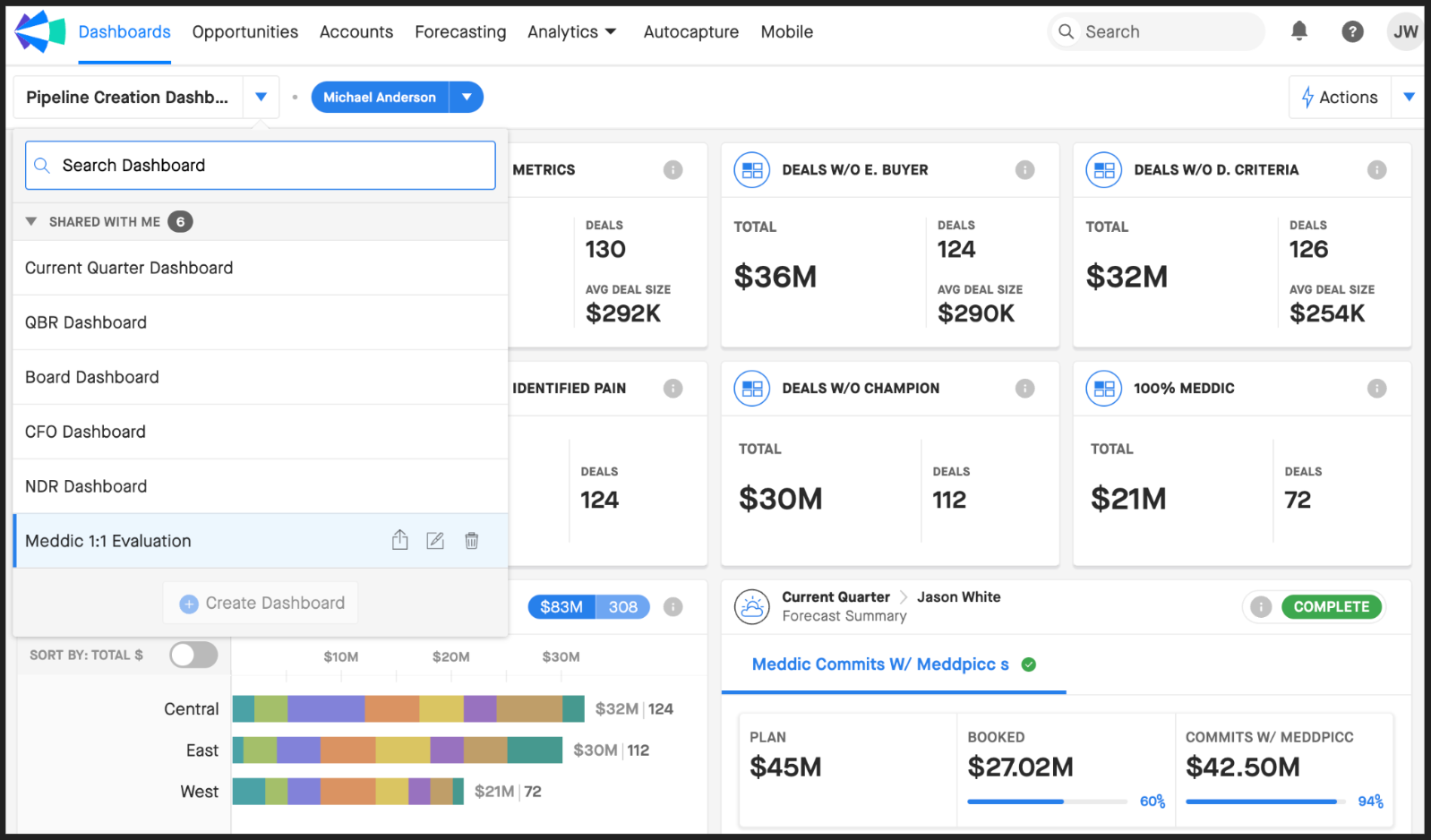

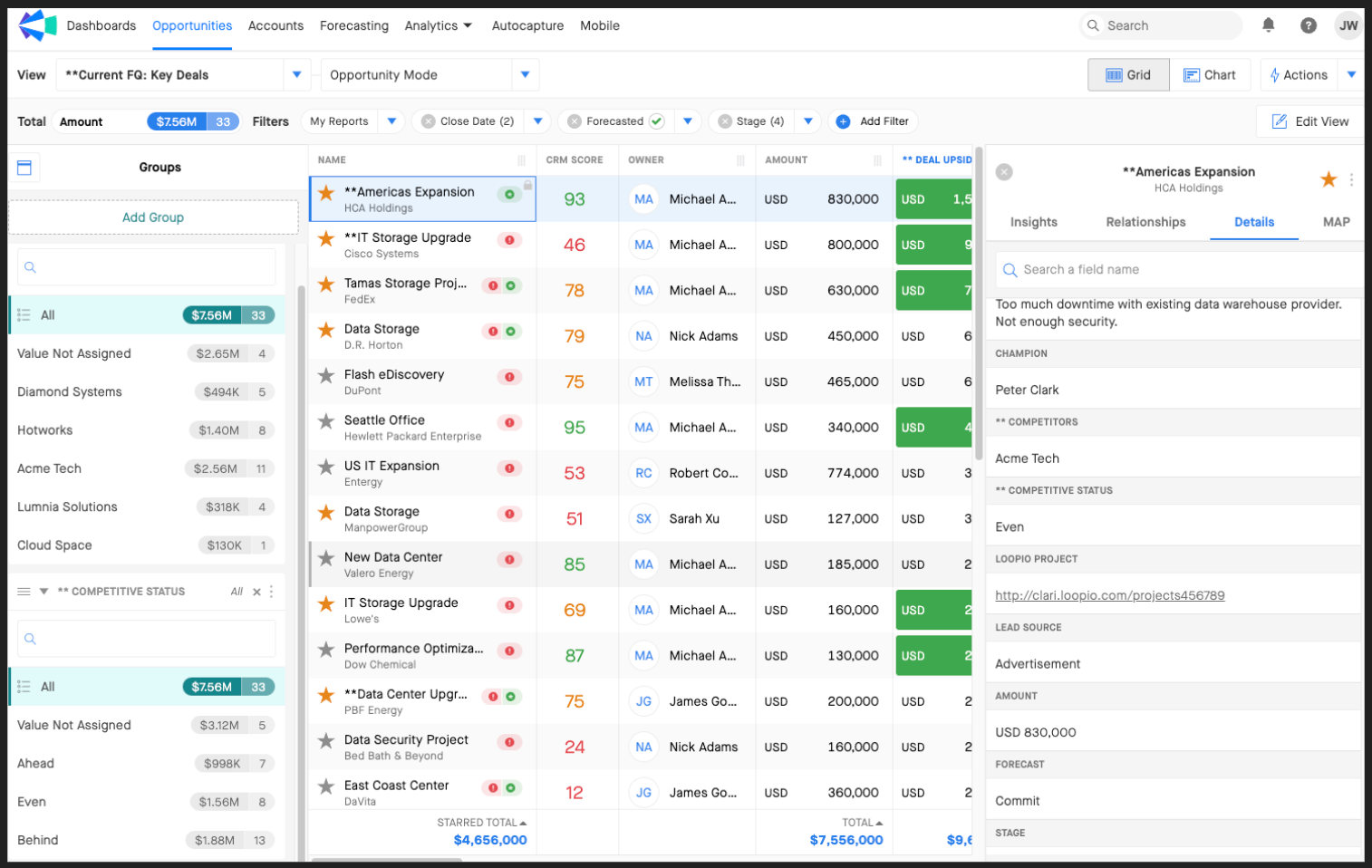

Dynamic Dashboards — MEDDPIC Example

- Quickly pin opportunity data, forecast information, or insights from Clari’s analytics modules to your shared (or private) Dashboards.

- Using MEDDPIC field data, you can build a MEDDPIC Dashboard to help ensure that sales is adhering to your methodology/process and your forecast.

- Creating a dashboard provides you with a one-stop shop for understanding which deals are where in their lifecycle.

- Dashboards, like every Clari analytics module, can be filtered by team or rep using the Scope:

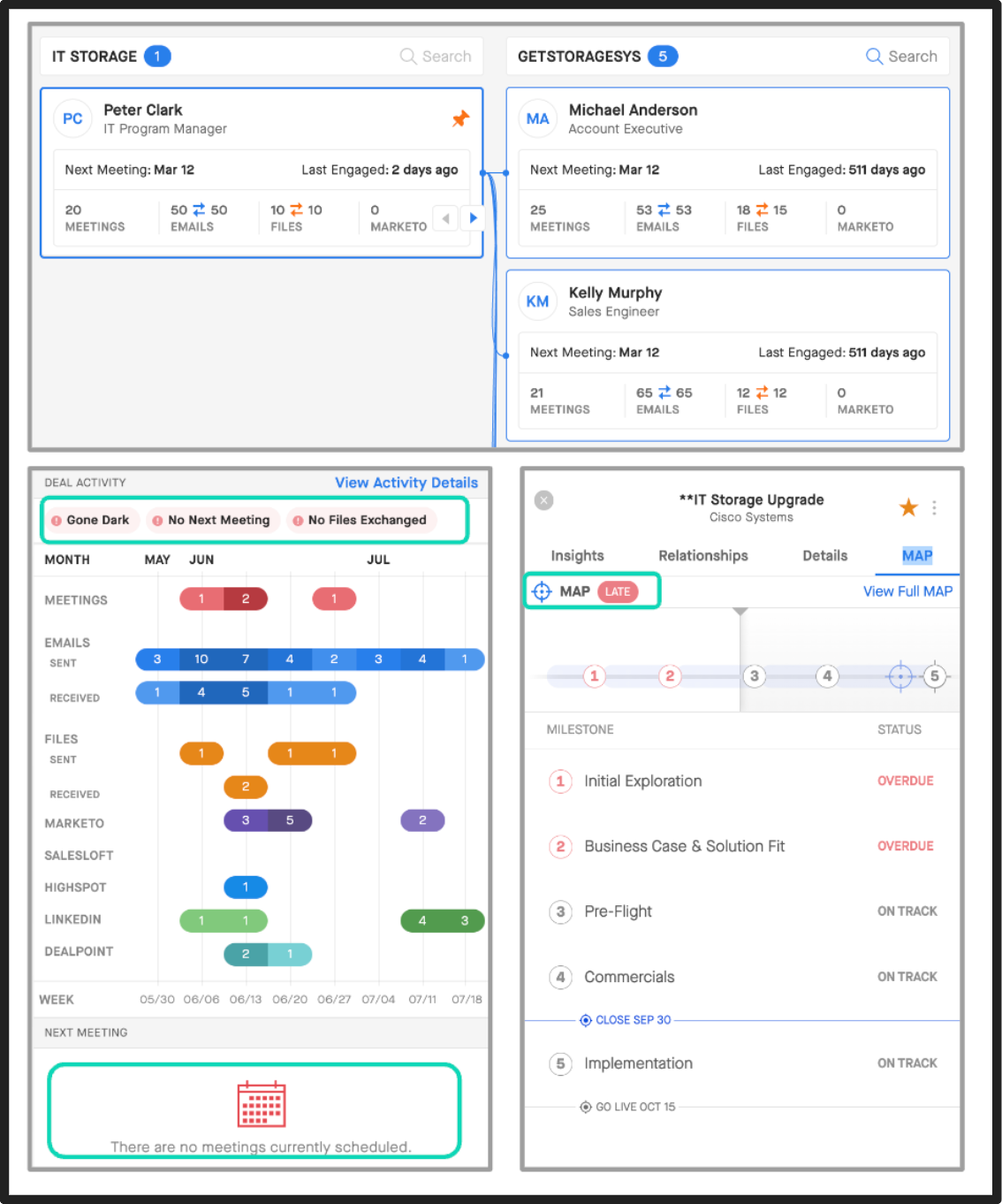

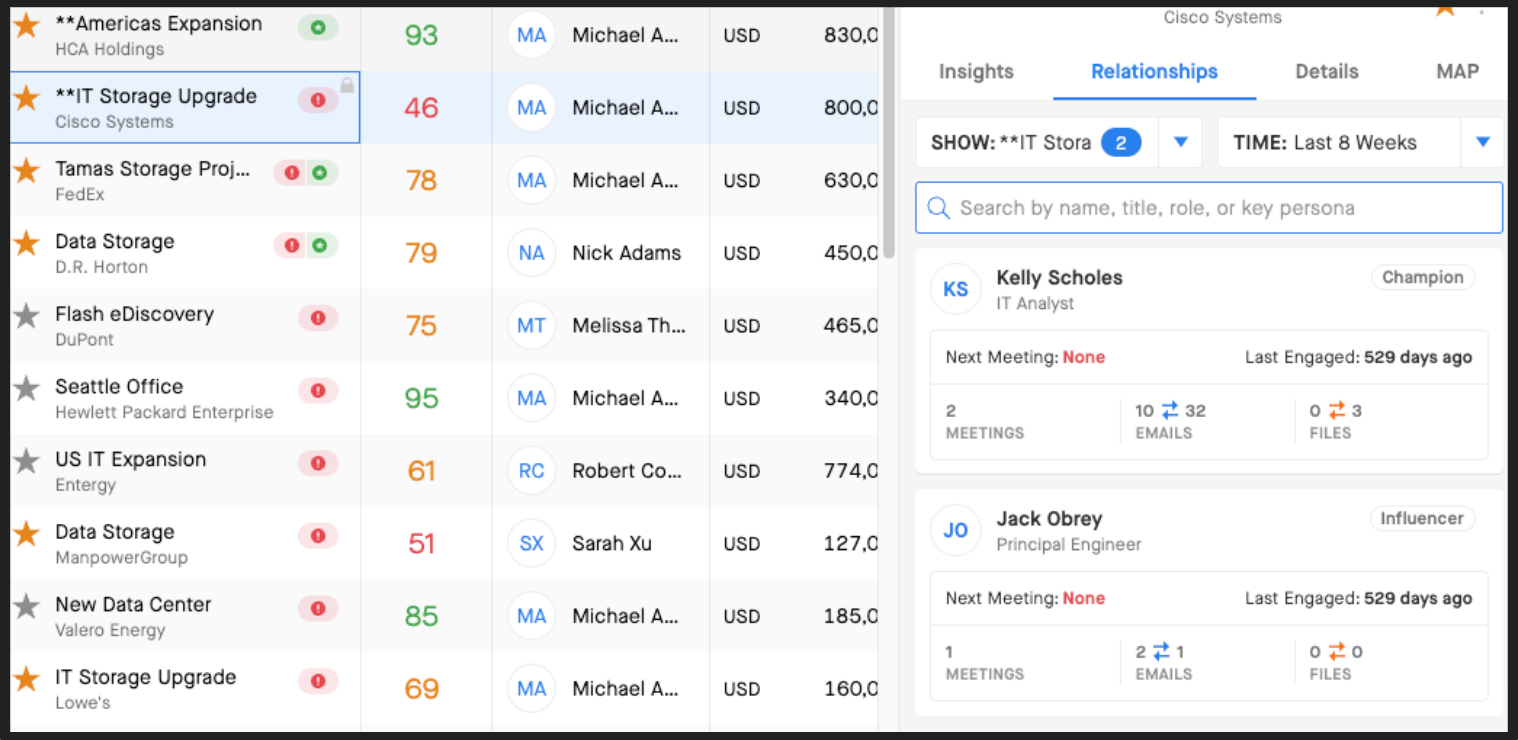

Activity & Hygiene with the Insights Panel (Example)

Win more deals and prevent slipped deals by identifying where reps are spending time and if they are getting the right engagement to close their deals on time.

From the Insights Panel in the Opportunities Module:

Observations

- Not multi-threaded and below the powerline

- The client has gone dark

- No next meeting

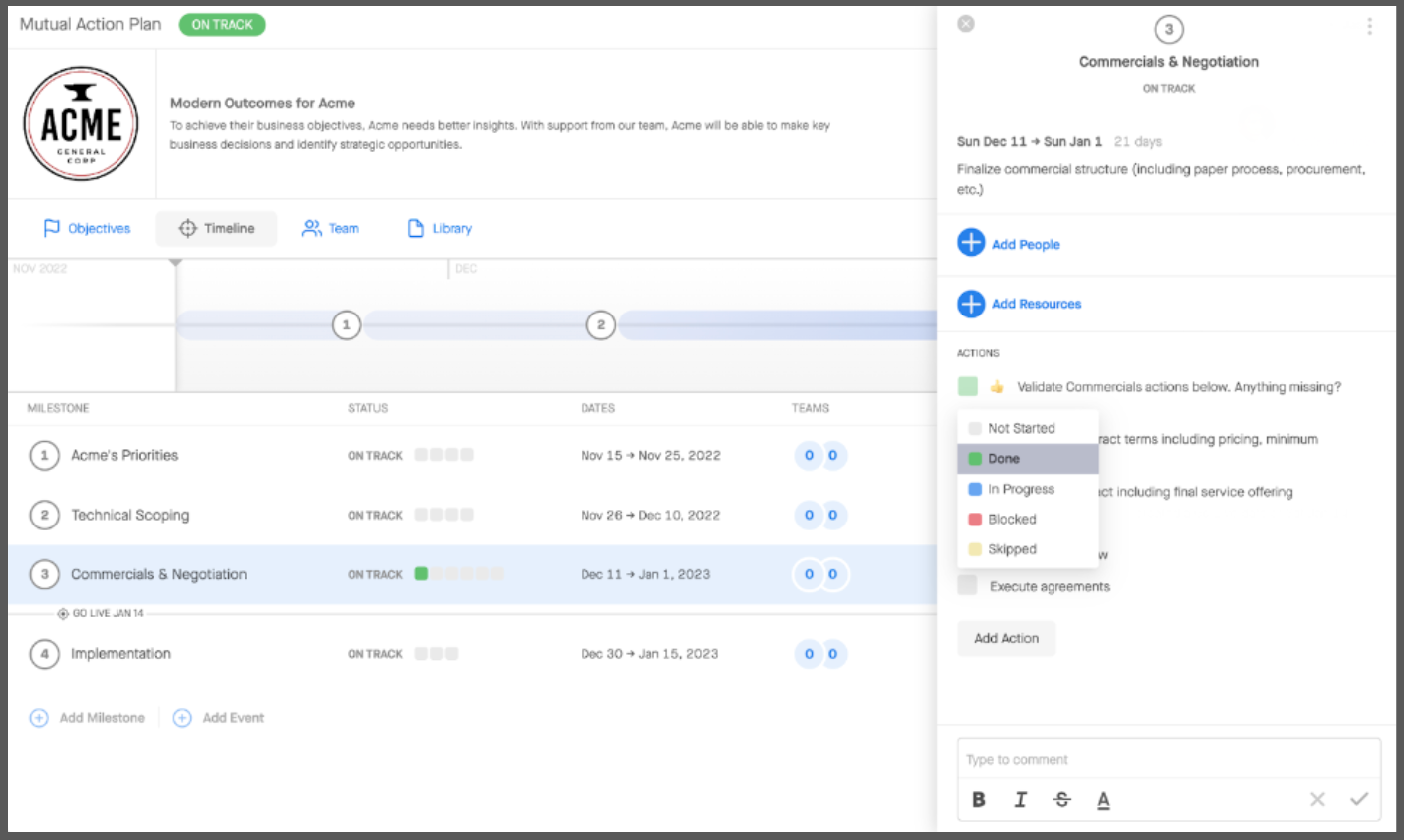

- Buyer and seller are not aligned with an on track mutual action plan (MAP)

Recommendation

- Can we get above the powerline?

- Can we arrange a next meeting?

What is required to view this data

What is required to view this data  in Clari?

in Clari?

- Connection to SFDC

- Connection to Email/Calendar

- Admin must build a Mutual Action Plan Template

- Required from SFDC: Stage field, MEDDPIC fields, Role Hierarchy Setup

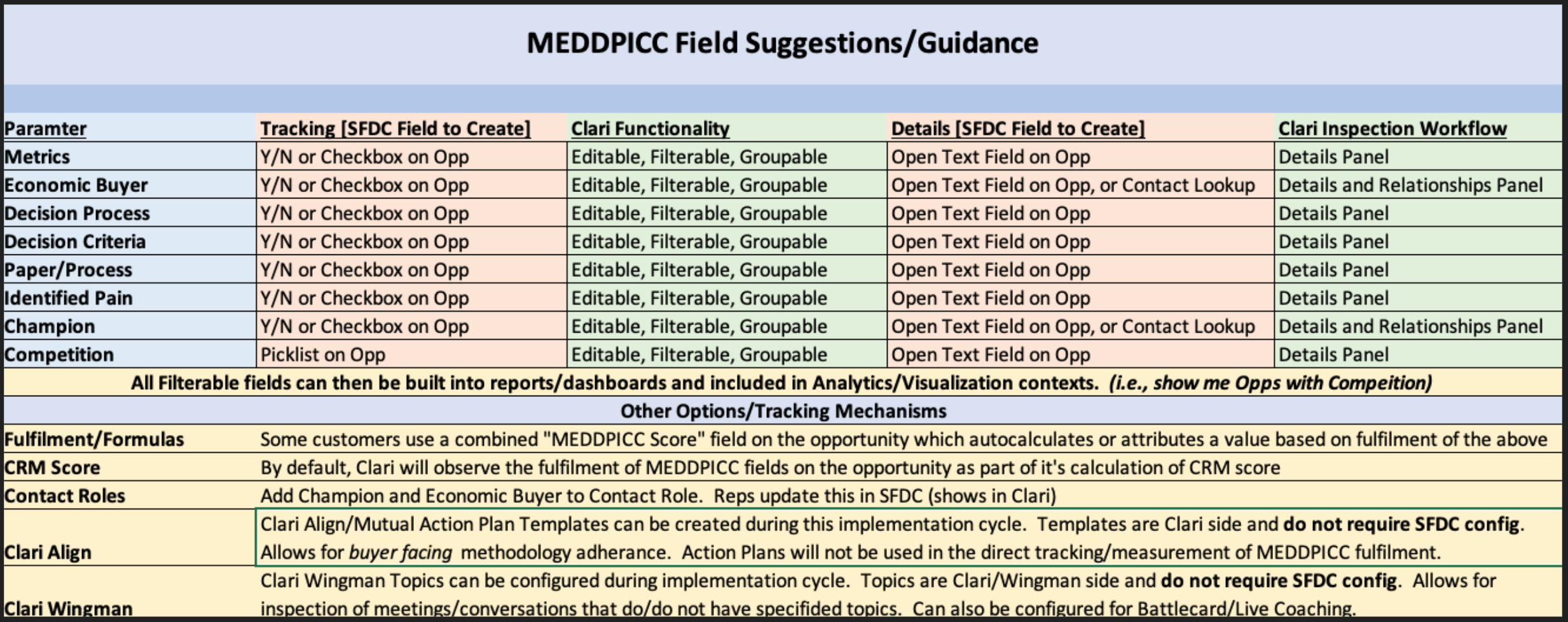

MEDDPICC in Clari

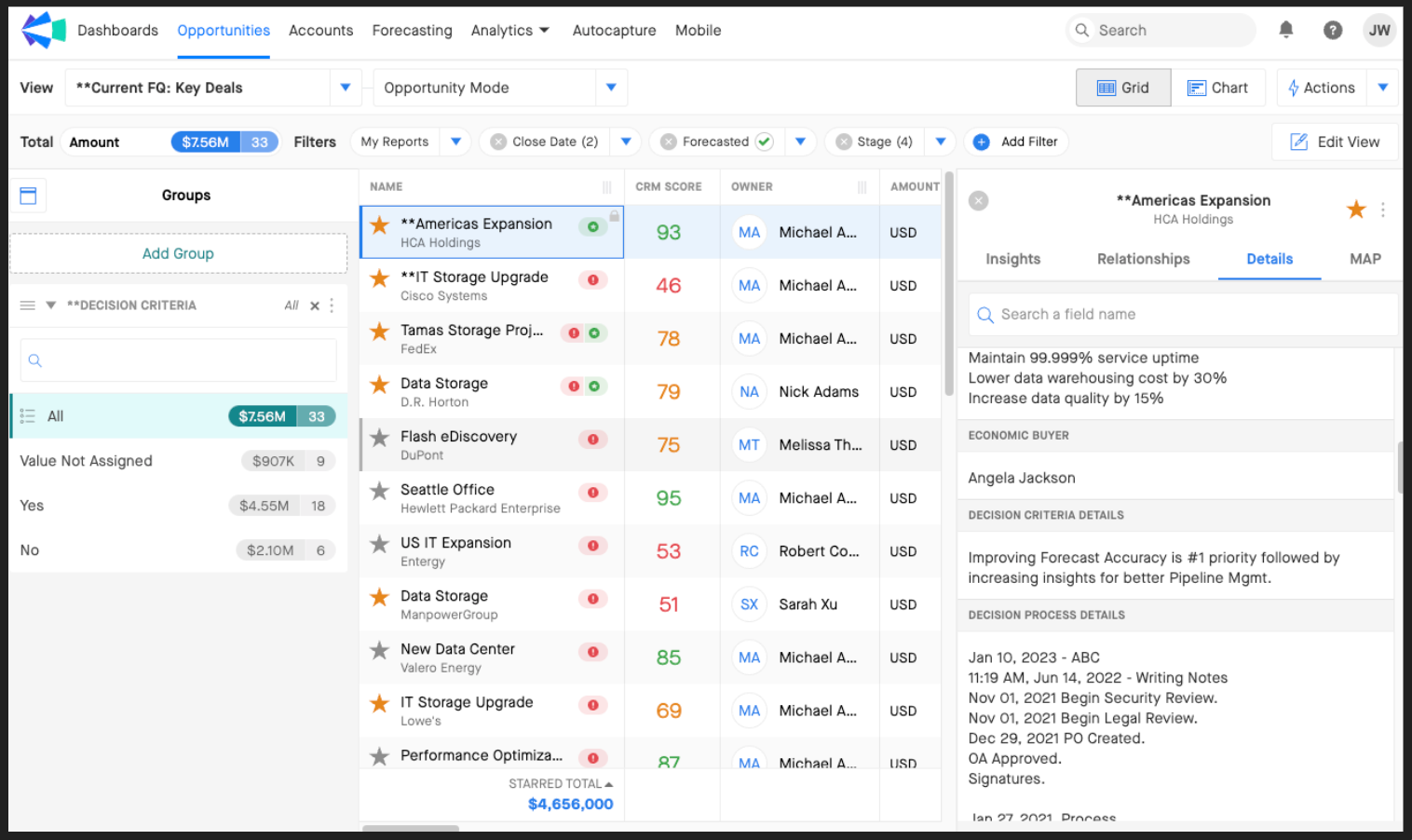

METRICS: Agree upon Metrics and Mutual Business Objectives

Metrics are all about convincing your prospect with hard numbers. What is your business case? Think of the hard dollars, the real value, and the KPI improvements that your solution brings that justify a change. You need real numbers here. Don’t guess.

With these numbers, you’ll paint a picture for your prospect that compels them to buy. Imagine a lever on a wall. When you pull that lever, the business machine moves. Your goal with Metrics is to understand the financial impact of those levers being where they are now and show your prospects how your solution can move those levers.

What this might sound like:

“Can we agree that improving these areas will save you time, increase productivity and grow revenue?”

“If we make these changes, what % improvement could be seen across the levers?”

To Do:

- Define triggers in Copilot

- Identify Key Levers in Align

- Key Metric defining fields in SFDC

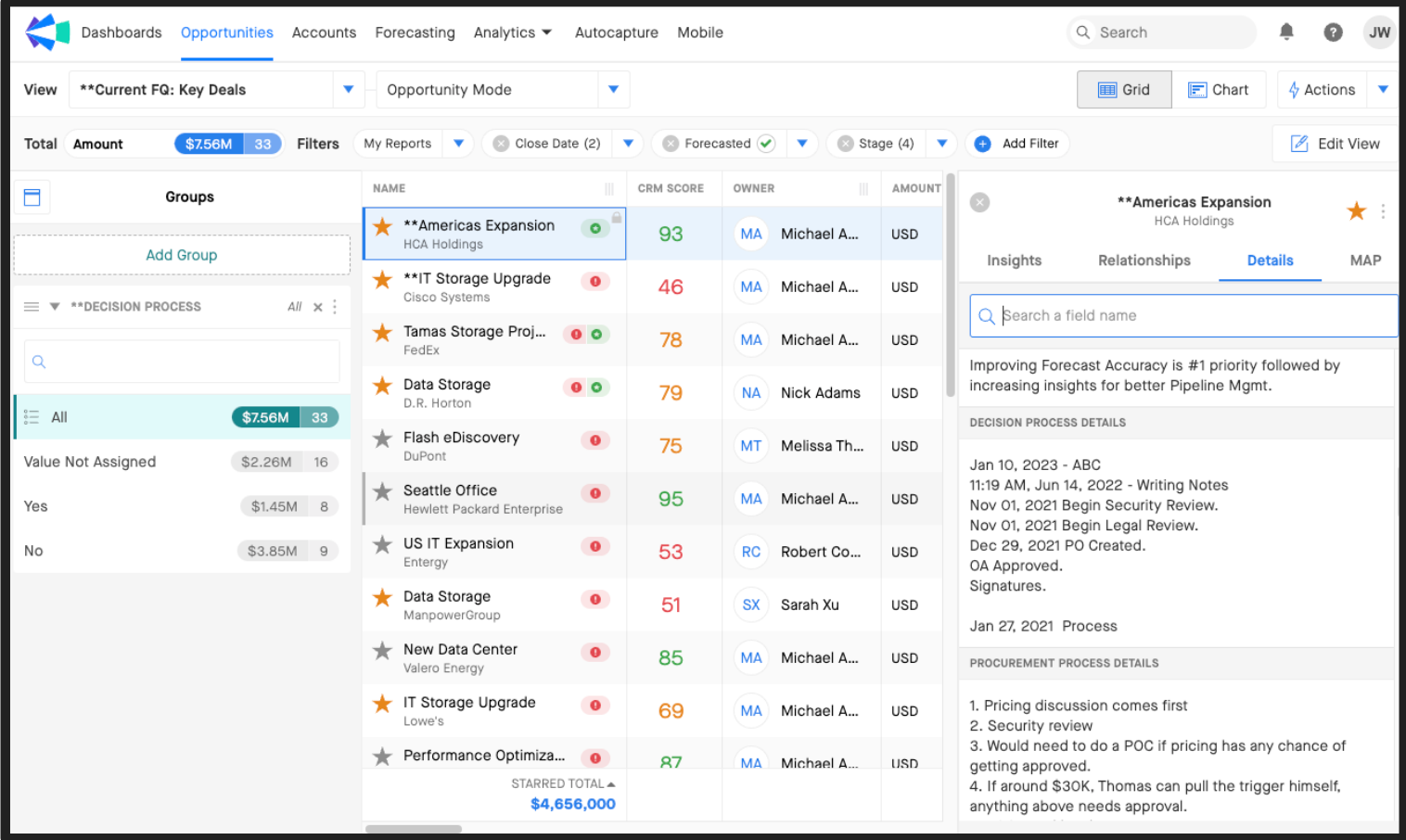

ECONOMIC BUYER: Identify an Economic Decision Maker in Team Roles

Ever gotten to the end of your process and been told, “I need to share this with someone,” or, “I don’t have budget,” and then lost the deal? The E stage of MEDDPICC is all about solving that by identifying your economic buyer.

Find out who can spend money, who has budget, who can create budget, and who can sign the contract. This is your economic buyer, and this will be the person saying ‘yes’ to your great idea! They are the ultimate decision maker. You want to meet this person early in the process.

Make sure you understand their vision and their pain. They are often very busy, but if you understand the challenges they have, clearly state the problem you solve, build trust, demonstrate the ROI, and help them get there, you will get their attention! That doesn’t mean you ignore everyone else, though.

It’s OK to work with several people during an opportunity. In large deals, you may see 6-8 or even more. But as you work with other members of your prospect’s decision team, be sure to share your findings with the economic buyer. And make sure they’re a part of your final presentation, your business case review, and contracting.

What this might sound like:

“What is your vision of success? What is preventing you from getting there sooner?

“Who can spend money? Who has budget? Who can sign the contract?”

To Do:

- Define triggers in Copilot

- Identify Key Roles in Align

- Connect to Inbox in Clari

- Defining Economic Buyer in SFDC

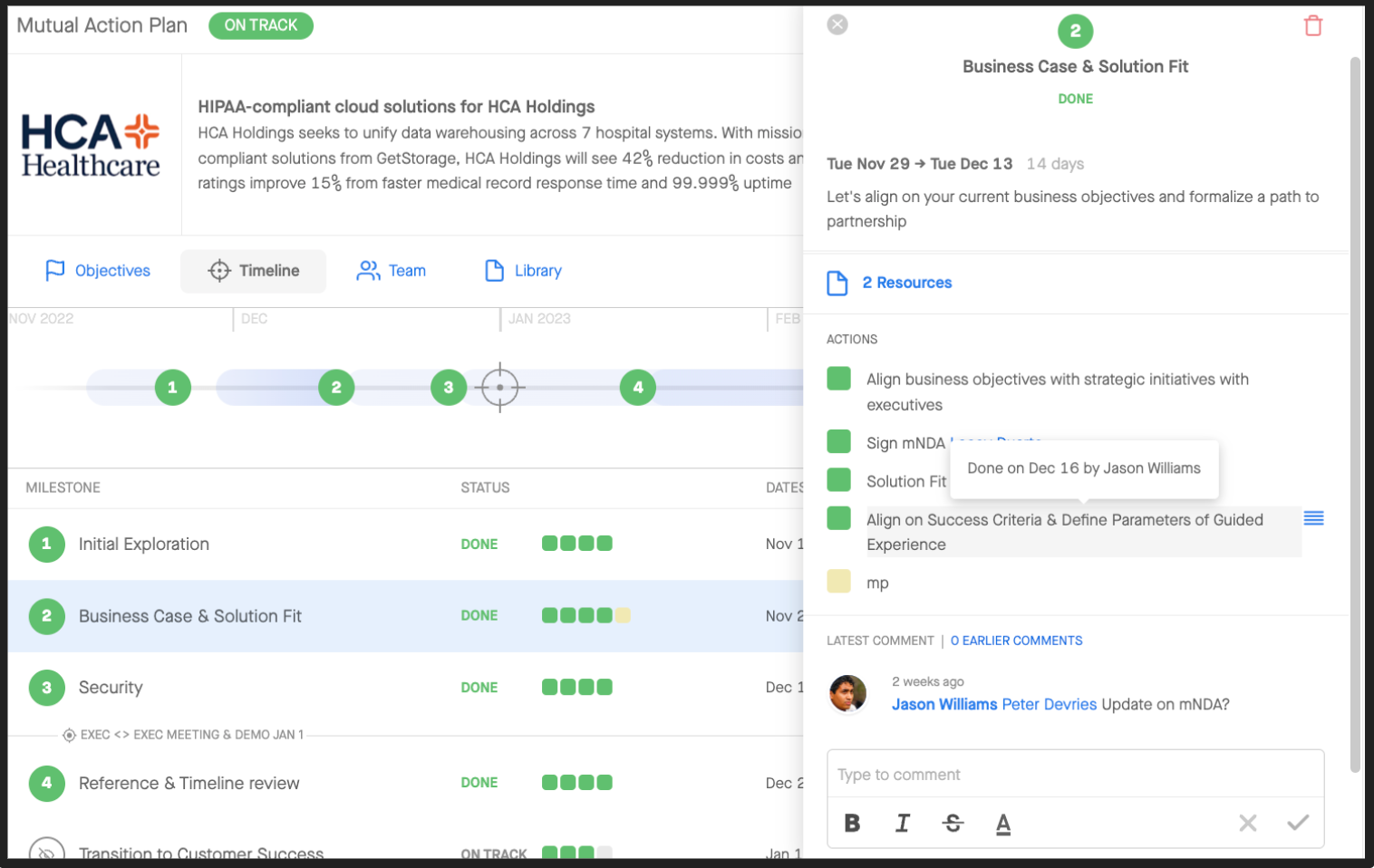

DECISION PROCESS: Agree upon a Decision Process and Milestone

Do you have a mutual action plan that was co-created and agreed-upon? If not, you have a gap to coach and observe where to take action. The purpose of this stage is to understand the path so you can walk hand-in-hand with your buyer through the purchase. This step gives you permission to hold both sides accountable to the agreed upon journey. Without clarifying the decision process, you may have a deal, but you’ll have no idea when you’ll actually win it. You can’t forecast accurately without this step.

What this might sound like:

“When does your client want to be live and why? What is their buying process?”

“Who are all the players, and what are their responsibilities?”

To Do:

- Define triggers in Copilot

- Identify Key Roles in Align

- Define how to coach for forecasting accuracy

- Connect to Inbox in Clari

- Defining Economic Buyer in SFDC

DECISION CRITERIA: Agree upon Decision Criteria in the MBO or POV milestone

This stage is all about understanding the feature functionality your buyer is looking for and how closely your solution aligns with it. Find out what’s on your prospect’s wish list. What items will you be measured on, and what will you need to achieve to earn their business? This allows you to identify differentiators they should be aware of.

The end goal of this stage is simple — to find out what the prospect wants so you can effectively coach them and guide them to the recommended solution.

What this might sound like:

“What are you looking to get out of a solution?”

“What outcomes are you wishing to achieve?”

To Do:

- Define triggers in Copilot

- Identify Key Roles in Align

- Connect to Inbox in Clari

- Defining Economic Buyer in SFDC

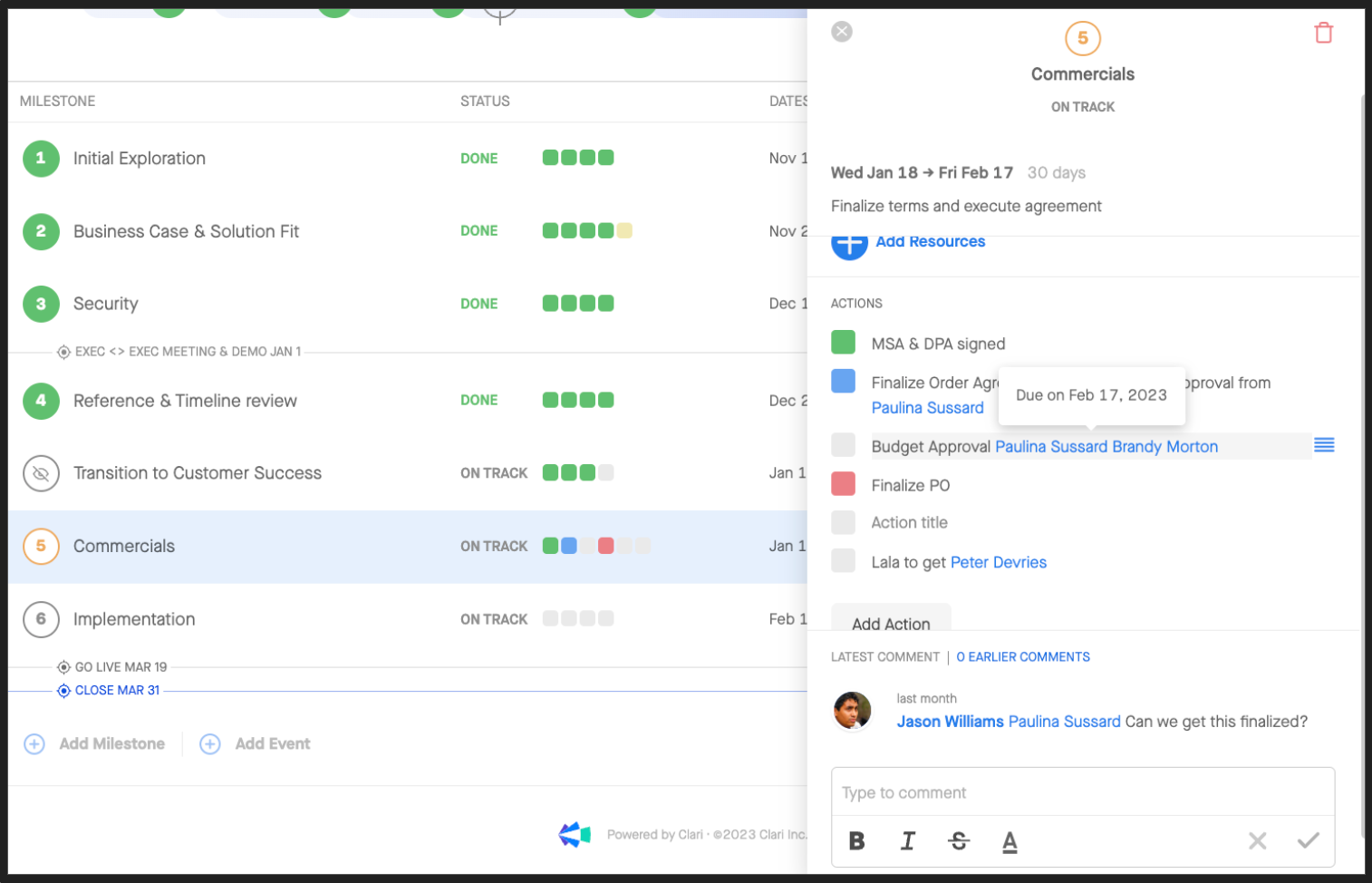

PAPER PROCESS: Manage the Paper Process in a milestone

business process ≠ legal process

The purpose this step is to understand things like:

- How long your prospect’s legal process typically takes

- If they have inside or outside council

- Who is reviewing

- What the level of priority is

- If the signature process has changed

...So you can make sure deals close on time.

The business may be ready to sign, but legal could quite literally rewrite an entire agreement, or spend months defining terms because outside council is getting paid by the hour. Remember, if you aren’t getting squeezed, you aren’t getting a deal. Don’t offer any concessions until you’re at this step, and understand every ask holistically. You need to understand your prospects priorities and non-negotiables.

Have your give-to-gets and trades mapped out beforehand, and remember that saying no can get you to yes. This may sound difficult, and it can be. But the good news is that when you nail the paper process, you can often nail the signature date down to the day or even the hour.

What this might sound like:

“How long your prospect’s legal process typically takes if they have inside and outside council?”

“Who is reviewing the business case? What level of priority is if the signature process has changed?”

To Do:

- Define triggers in Copilot

- Identify Key Roles in Align

- Connect to Inbox in Clari

- Defining Economic Buyer in SFDC

IDENTIFIED PAIN: Specify the Identified Pain in Mutual Business Objectives

Do you know why your prospects might make a change, and why they might to that now? What is each function’s challenge in the current state? What would be their personal/professional win if they were to make a change? If they don’t make a change, what happens?

If you don’t know their true pain point, it’s hard to connect their problem to your solution without making assumptions. We can see surface pain, and we connect the dots from past conversations. We can make assumptions, and then we make recommendations — big recommendations for massive change — without really understanding.

This step is your chance to stop doing that! Dig deep here. Keep asking, “Then what happens?” And “What else?” You are only free to recommend a solution once this step is complete — once you know what the prospect’s real problems are, what their goals are, and what their outcomes will be.

This — along with Metrics — will solidify your “Why change?” message. Identifying pain is how you sell emotionally. Metrics are how you justify rationally. Identifying pain connects you back to the Decision Criteria and allows you to demo the solution to the prospect’s exact problem. Don’t present without identifying their pain.

What this might sound like:

“If you don’t make a change, what happens?”

“What else is impacting the roll-out?”

To Do:

- Define triggers in Copilot

- Identify Key Roles in Align

- Defining Pain in SFDC

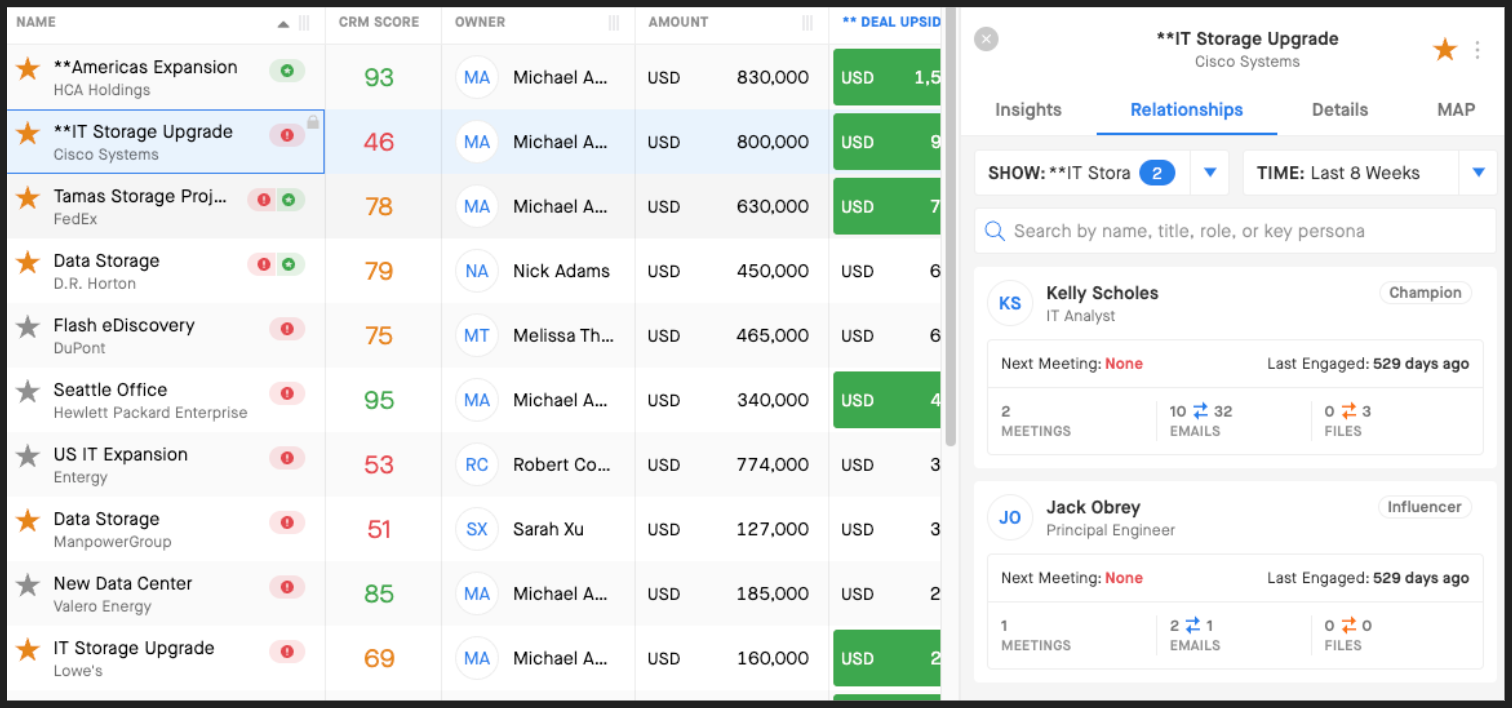

CHAMPION: Identify a Champion in the Team Roles

Who has the most to gain with your solution? Who is the end-user that will get the biggest benefits? Who is leaning in and giving all the verbal cues in your presentations?

That is your champion-in-waiting, and if you haven’t built a relationship with this person, do that now! Foster this relationship, nurture it, and watch your opportunity grow stronger. There are several things you can do to build these relationships.

For instance, ask for a separate meeting with them to understand and empower your champion. Educate them, and have them present information back to you. Ask them to prep for meetings with you. Send them communications or information to vet out and cascade on your behalf.

What this might sound like:

“Who has the most to gain? How strong is the relationship?”

“Who are the end users getting the biggest benefits?”

To Do:

- Identify Key Roles in Align

- Connect to Inbox in Clari

- Defining Champion in SFDC

COMPETITION: Specify Competition in Clari.

Who are your competitors in this deal? What differentiates you from them? What landmines can you set? What customer stories can you tell that will resonate with your prospect, based on everything you have learned about them?

When talking about competition, focus on unbiased honesty when it comes to the pros and cons. It’s tempting to talk up your own solution and talk bad about your competition, but don’t get caught in a lie (or even an exaggeration). Always take the high road.

And don’t forget the one competitor we all have in common — the status quo. Metrics and Identifying pain are two of your best tools to beat the status quo. The second thing that can help you beat the competition is being an expert.

You know what you are solving for. You know what’s important to the buyer. And you know how to differentiate yourself. So be the expert you already are.

What this might sound like:

“I know this is important to you. How do we compare?“

“Companies that leverage __ see __ benefits from __ solution”

“Many companies are looking for __ in a solution, and this is what sets us apart.”

To Do:

- Define triggers in Copilot

- Defining Competition in SFDC