4 trillion.

As we announced last week, that’s the amount of closed-won revenue flowing through the Clari Revenue Platform.

We’re the first company to surpass $4T of revenue under management, making us the Revenue Platform Category Leader.

$4 TRILLION (with a T).

For perspective, that’s the approximate market cap of Alphabet (Google) + Amazon. It’s more than the UK’s GDP.

And thanks to our amazing customers, we know more about running revenue than any company on earth.

Why? We’re constantly collecting terabytes and terabytes of revenue data and analyzing how companies manage their enterprise revenue process.

All day. Every day.

As the first RevTech company to cross $4T of revenue under management...

- We have the largest revenue database in the world, which fuels our best-in-class Rev AI.

- We have the widest and deepest product functionality on the market.

- We have the most expertise for running revenue of any player in the space.

- We have the largest footprint of massive multi-billion publicly traded companies leveraging our Revenue Platform.

And at Clari we’re committed to using all our data, expertise, and technology to help you stop revenue leak and capture more revenue predictably and repeatedly.

Because here’s the truth: Expectations are still rising.

Investors still demand growth.

Executives are hunting for more efficiency.

Employees are under-resourced and overworked.

The old process playbooks are good, but they’re not great. Cost-cutting isn’t enough. And boards and investors expect revenue leaders to become AI leaders overnight.

You need a new plan.

After a decade and $4 trillion...

Here are the 5 biggest learnings to help capture more revenue

Learning #1: You’re not missing targets because of low pipeline coverage

Attainment is low because of Revenue Leak — aka breaks in your revenue process.

It’s 2024 and most CEOs still can’t answer the most critical question in their business:

Are we going to meet, beat, or miss on revenue?

Revenue goals are not being met (or exceeded) due to profound revenue leak — the loss of revenue that results from breakdowns across the end-to-end revenue process.

Revenue leak is the biggest problem hiding in plain sight.

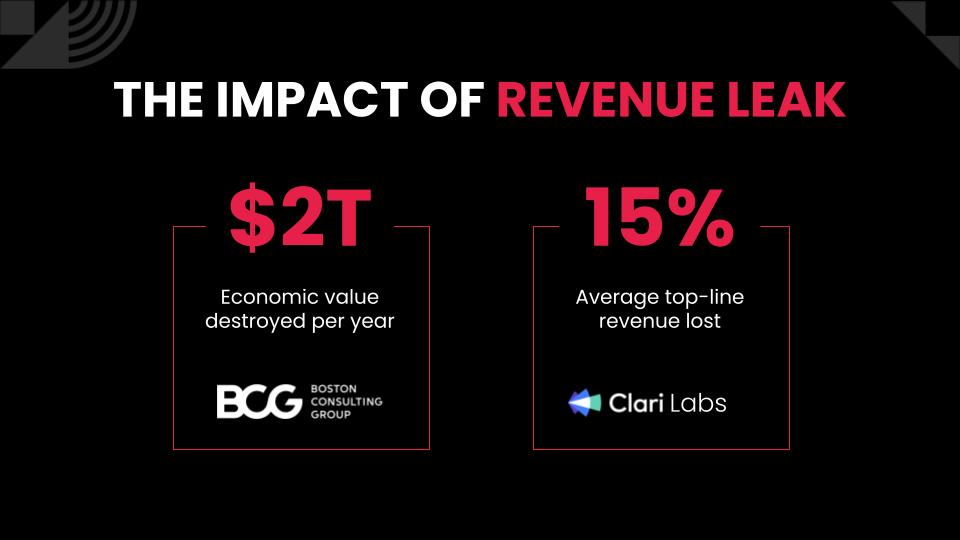

On average, you’re losing 14.9% of your annual revenue because of revenue leak (Clari Labs, 2022). When we look at this number globally, it balloons to $2.1T in economic value destroyed yearly due to revenue leak (BCG, 2022).

Why is this happening? Outdated and disconnected tools. Spreadsheets + CRM + BI + Point solutions = Revenue Leak.

How can we manage our most important business process with outdated and disconnected tools?

An example, through the eyes of a typical B2B SVP of Rev Ops:

It’s Monday morning, and you are elbows deep in your CRM, hoping to get a handle on the week ahead. What are your teams up to?

You want to run a report to share with your sales org. So... you grab a file from your CRM and download it to a spreadsheet for “easy” slice and dice. But you need more. So, you dial up your BI tool and start adding to the report.

Just like that, all collaboration is out the door. There is no efficiency. “Easy” doesn’t exist. There’s no governance on reporting and no best practices on how to act across this data.

Now, you’ve spent hours and hours toggling between four or five point solutions to get a single report. And you still don’t trust what you’re looking at…

This broken process is a classic (and all too common) example of revenue leak.

But it doesn’t stop there.

Learning #2: Revenue leak is even worse in the enterprise

But not for the obvious reasons….

For context, at Clari, we consider enterprise organizations as customers with “huge books of business.” But we are not talking about a “mere” $500M in ARR. We’re talking about $5 to $10 to even $20B (billion!) in revenue.

Clari got “pulled upmarket” as our customers grew, forcing us to mature to keep up with the increasing sophistication of their revenue motions.

And we realized that as companies scale beyond $1B, up to 50% of the employees are now “revenue critical.”

But without a single platform to run revenue, leak is pervasive. At the enterprise scale, millions of dollars are left on the table every quarter.

Imagine you’re doing $1,500,000,000 in ARR.

Then you lose 15% to revenue leak every year.

That’s $225,000,000 of revenue gone.

And it’s not going unnoticed anymore….

Learning #3: Boards and investors are relentlessly digging deeper into how the revenue engine performs

Boards and investors are pushing organizations to know "every detail and nuance" of how the engine is performing: where there are breaks (ie, leaks), what the growth levers are, what current state of performance is, and how it compares to where you want to be against goal, for areas of improvement.

In short, they’re demanding more predictability.

They are mandating:

- A true understanding of how revenue leaders will hit their number

- Strong sales efficiency and program performance

- An explanation of how and why pipeline creation and forecasting methodologies change

Boards and investors realize growth and strategic planning are at risk without a complete view of their end-to-end revenue process.

We’ve seen a tremendous macro shift from “growth at all costs” to “efficient growth” and the rule of 40 (growth rate + profit margin equal to or greater than 40%).

Teams are now being asked to lean in hard on all aspects of revenue — how the revenue org has been designed, how it’s enabled, how it’s measured, and how we know if the levers are working.

There is increased scrutiny to be intentional, lean, and predictable.

CROs must build durable and profitable sales organizations that can create, convert, and close efficiently.

The movement from growth at all costs to efficient growth has caused a renewed focus on rep productivity and attainment. You can no longer ‘throw bodies” at revenue targets. It's now about data, APIs, and AI.

The first question in enterprise planning is: What are your revenue cadences?

And the answer must be based on high confidence, as this revenue number drives everything. If you get that number wrong, the plan falls apart. You’ll have layoffs and restructures — and your company will lose its valuation.

Finally, the revenue process is essential — especially from the investor/finance world. All resource planning starts with a well-formed revenue plan. If you don’t have predictability, you can’t plan how you will run your company.

However, an effective revenue process cannot thrive without a cadence.

Learning #4: Revenue leak and low governance have sparked the need for Revenue Cadences

Revenue leaders don’t know what their teams do every minute of every day across every week of a 13-week quarter.

And boards and investors are stuck in the Stone Age – getting a set of PDFs about revenue performance sent every 90 days over email. It’s unacceptable.

So revenue leaders are getting more methodical and disciplined. This is in service of driving better revenue governance. What, exactly, are they doing? First, they’re rushing to blueprint their entire end-to-end revenue process – each revenue cadence: new logo cadence, renewal cadence, upsell/cross sell cadence, and more.

Why? They want to control their results and reach their ever-growing targets. Why use the word “control”? Why use the word “governance”? The ultimate goal is to build a business that can create sustained and durable growth and profits over a long arc, driving the value of the company (whether private or public) over time. Executive teams are looking to ‘engineer’ a beat and raise cadence, quarter over quarter. The game is to build an efficient, growing, and sustainable business. When it comes to running revenue, it all starts with optimizing the Revenue Cadence(s).

It’s time for a fully instrumented revenue cadence, complete with real-time, historical, and predictive insights across all three actions: create, convert, and close. The lack of focus on the revenue cadence is a fiduciary violation.

After building a wonderful product or service that customers love, a company needs to build and scale the engine that creates revenue from the products or services they sell. Revenue Cadences are the cylinders (or lithium batteries) of the engine.

Revenue Cadences are the operating system across your organization that drives consistent execution of the revenue strategy. They’re the missing link to creating, converting, and closing revenue repeatedly and predictably.

Think of them like quarterly revenue sprints. They are the revenue-critical workflows that have a direct impact on revenue leak.

The key to winning. Without them, there’s job loss.

The 7 most essential revenue cadences

Cadences drive consistent execution of the CRO’s revenue strategy up and down the hierarchy for close collaboration and rigorous governance. Every cadence needs to be designed to drive repeatable and predictable outcomes.

At Clari, these are the most important and impactful revenue cadences every B2B organization should be running:

- Individual Performance

Taking the right actions at the right time: 1:1s, territory plan with SDR, prospecting, account health QBR/EBR, deal review

- Team Performance

Driving better performance within and across teams: Kickoff, small team, all-hands, SOE

- Top of Funnel

Building early-stage coverage to hit targets: Pipeline + territory + activity review

- NL & Expand Forecast

Forecasting accurately across new and existing: major deal review, CQ forecast, slipped deal review, next quarter forecast, 2+ quarter forecast, CRO call

- Renewals Forecast

Identify, plan, minimize, and mitigate attrition: CRO call, at-risk review, CQ renewals, next quarter renewals, 2+ quarter renewals

- Retro

Analyze, review, and iterate on strategy: funnel analysis, win/loss analysis, pipeline council, root cause analysis, affirm or redefine KPIs

- Exec Staff & Board Relations

Communicate to the board: exec staff, board flash, board meeting

Revenue Cadences are about governance — designing, instrumenting and running them in service of a ‘beat and raise’ cadence for durable increases in shareholder value over time.

Learning #5: If you don’t have an AI council, you’re signing up to get left behind

Without an AI revenue strategy, it’s impossible to govern and control your revenue process.

AI is the most significant opportunity of our generation.

The larger the company, the more profoundly AI impacts revenue.

And CROs are not waiting around for something to happen. They are in proactive mode, starting up cross-functional “AI councils” to stack rank where (predictive and generative) AI can move the needle.

Not setting up an AI council? Be prepared to be lapped by your peers.

These AI councils also allow CIOs to move from the traditional admin/IT/compliance roles into a much more prominent seat at the revenue table.

CIOs who are diving headfirst into generative AI will empower them to be directly in the center of the create, convert, and close conversation.

CIOs now have AI mandates — strategy and budget. There is nothing more strategic than revenue. Revenue is no longer just managing data and tools. It’s about creating an AI strategy to capture more revenue across your business.